Update: During a White House press briefing in the aftermath of the ruling, Trump said he will sign an executive order on Feb. 20 “to impose a 10 percent global tariff under Section 122, over and above our normal tariffs already being charged.”

The President also stated that his administration will initiate “several Section 301 and other investigations to protect our country from unfair trading practices of other countries and companies.” He indicated that he will not seek congressional approval for new tariff authorities.

About Section 122

Under Section 122 of the Trade Act of 1974:

No formal action has been taken by the Administration at this time, and additional details are not yet available

We are monitoring the situation and will provide updates if any changes occur.

Update from the J.O. Alvarez, Inc. Compliance Team

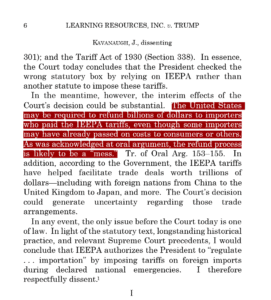

On February 20, 2026, the U.S. Supreme Court issued a decision in Learning Resources v. Trump confirming that the International Emergency Economic Powers Act (IEEPA) does not authorize the President to impose tariffs. This ruling affirms that tariffs imposed under IEEPA authority were not legally supported.

Link: Learning Resources v. Trump

Although the Supreme Court struck down the legality of IEEPA-based tariffs, the Court did not address whether refunds must be issued, nor did it provide guidance on when or how refunds would be processed.

At this time:

There is no formal confirmation from U.S. Customs and Border Protection or other authorities on whether tariff refunds will be issued.

There is no published timetable or procedural roadmap for refunds.

If refunds are authorized, it has not been determined whether they will be automatic or require formal claims.

There is no confirmed timing on when refunds, if issued, will be received.

We are awaiting clarification on:

Whether refunds will be issued

How refunds will be administered

CBP has updated its refund procedures such that all duty refunds are issued electronically via Automated Clearing House (ACH) through the Automated Commercial Environment (ACE) Portal. Paper checks are no longer routinely issued unless a waiver is approved.

To prepare for potential refunds, we strongly advise that clients:

Confirm an active ACE Portal account — you must have ACE access to receive electronic refunds.

Verify ACH enrollment in ACE — CBP will issue refunds only via ACH through ACE, and correct U.S. banking information must be on file.

Ensure banking information is up to date in the ACE Portal’s ACH Refund Authorization tab.

CBP’s official guidance on this transition can be reviewed here:

ACE Portal – ACH Bank Information for Electronic Refunds (CBP) ACE Portal ACH Refunds Guidance – CBP

CBP Electronic Refund Enrollment FAQs (issuing refunds electronically) CBP ACE Portal & ACH Refund FAQs

Failure to have valid ACE and ACH setup could delay or prevent receipt of refunds once issued.

While the Supreme Court has ruled on the legality of IEEPA-based tariffs, we have not yet received formal guidance from CBP confirming:

The effective date that IEEPA tariff collections will cease

Operational instructions to ports and data systems

Any transitional procedures related to ongoing entries

Until CBP publishes official implementation instructions, the precise timeline for cessation of these tariffs remains unclear.

Other tariff authorities, such as Section 301, Section 232, AD/CVD, and other trade remedies, continue as legally valid programs. These tariffs are not impacted by the Supreme Court’s IEEPA ruling and remain in force absent separate changes by law or administrative action.

The J.O. Alvarez, Inc. Compliance Team is actively tracking developments and monitoring for:

Official CBP guidance on tariff collections stopping

Any announcements regarding refund procedures

Updates in litigation or administrative policy

Changes to related trade programs

We will continue to update this blog as new information becomes available.

If you need assistance confirming your ACE/ACH setup or reviewing entries where IEEPA tariffs were paid, please contact our Compliance Team at [email protected].

Disclaimer: This communication is informational only and does not constitute legal advice. Decisions regarding compliance actions should be made based on official agency guidance once published.

—

JOA Compliance Team

J.O. Alvarez, Inc.

Copyright © 2026 J.O. Alvarez, Incorporated. All rights reserved.

Website Design & Development by Gibson Design